Fund Value Equity

Investment strategy with higher risk and return profile. Suitable for investors with higher risk tolerance. The strategy seeks to outperform the broad US stock market (benchmark is ETF fund SPY

).

The SPDR S&P 500 ETF (SPY) is an exchange-traded fund (ETF) that tracks the Standard & Poor's 500 (S&P 500) index.

Yield for 2023

%

20.6%

Estimated yield

(USD)

15%

Optimal investment period

from years

2+

The strategy uses machine learning

Investor Memorandum

Base currency

USD

Optimal investment period

from 2+ years

Minimum entry threshold

50 000$

Estimated yield

15%

Management fee

1.5%

Success fee

15%

Investor's profile

The Quantum Capital Fixed Income Plus strategy is suitable for investors, who:

Focused on high capital growth

Want to be part of stories with significant growth potential

Ready for significant fluctuations in the value of your portfolio

Prefer reliability and liquidity

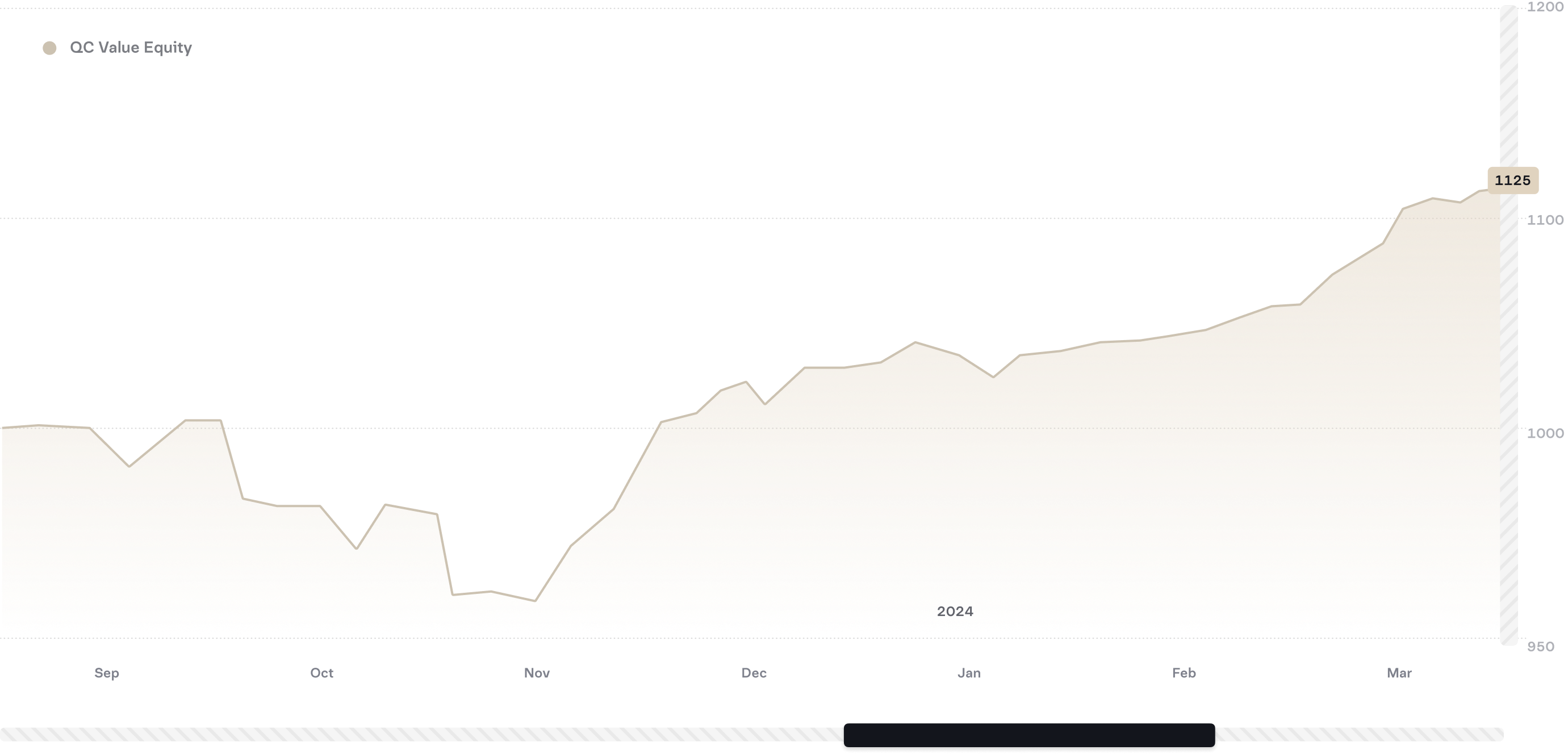

Value of fund units

The effectiveness of the strategy

March 2020 — June 2024

Accumulated yield for the period

An indicator of how much the strategy has grown since the strategy was launched.

65.8%

Average annual return

An indicator of how much the strategy has grown on average over the year since the strategy was launched.

12.89%

Portfolio volatility

An indicator of how scattered returns are relative to the average. Used as a measure of the relative riskiness of an asset. For example, a riskier asset has a high standard deviation.

8.76%

Sharpe ratio

A measure of investment performance that considers both the performance of a security or portfolio and its risks. I.e. the return on investment per unit of risk.

0.74%

Strategy tools

Given the strategy's goal of outperforming the U.S. equity market at comparative risk, the portfolio instruments should be broadly similar in type. The SPY index fund consists entirely of stocks of major U.S. companies.

70%

Shares of U.S. companies

More

Shares of U.S. companies

This is the main tool of the strategy. The SPY fund consists of these stocks, but only for the largest companies. To outperform the market, QC is also able to buy shares of smaller companies.

30%

Shares of companies from other countries

More

Shares of companies from other countries

This is a secondary tool of strategy. QC looks for investment opportunities everywhere and often international companies are more affordable than U.S. companies.

Additional instruments of the strategy - other instruments: bonds, notes, preferred stocks and currencies. These types of assets are allowed to be purchased in cases where we see a significant earning opportunity or intend to protect the portfolio from any expected risks. It is allowed to use derivative instruments in order to hedge risks.

ETF

ETN

ETC

All of the above instruments are allowed to be purchased both directly and through ETFs, ETNs, ETCs and structured products

Target portfolio structure

Deviations from the target structure are acceptable

Approach to investing

The basic idea is business ownership, not speculation. This strategy is effective in the medium to long term investment horizon.

Stage 1

Selection of companies through rigid filters

- Portfolio managers have an understanding and, more importantly, an interest in the industry in which the company operates

- The company has a clear and sustainable competitive advantage

- The company has been growing sales, profits and cash flow for several years

- Very competent and honest top management with a history of successful management

Only a small number of organizations pass all of the above filters.

Stage 2

Analysis and evaluation of selected companies

As we review the business, we push back

- From financial statements, company presentations, and analytics from major banks

- From independent sources: QC analysts read company product reviews, employee reviews on Glassdoor, Google and Twitter trends, reports and competitor presentations

QC portfolio managers need a deep and comprehensive understanding of the company's operations to acquire a stake in the business.

Stage 3

Formation of the portfolio

A high level of confidence in the analysis allows you to invest a significant proportion of assets in a single company - up to 15% of assets under management. Thorough analysis allows increasing portfolio concentration to achieve attractive returns. If there are unallocated funds, QC purchases ETF units and trusts the market to diversify.

Risk management

The main risks for the strategy

Market and concentration risk. We also consider currency and liquidity risk.

Market risk

The possibility of a decline in the market prices of instruments in the portfolio. This risk arises as a reflection of other risks - financial, operational, currency, political and other. QC intends to reduce the effect of this risk by buying companies at a discount to their valuation.

Concentration risk

Vulnerability of a portfolio to the performance of a single company or sector. If there is only one instrument in an investor's portfolio, he or she is completely dependent on the returns of that security. Multiple instruments, on the other hand, compensate for each other's movements and reduce concentration risk.

Currency risk

The probability that changes in exchange rates will lead to losses. However, it arises only when investing in non-dollar instruments. The Quantum Capital intends to purchase such securities only after careful macroeconomic analysis in order to minimize the currency risk.

Liquidity risk

The degree of difficulty in selling the instruments. The higher this risk, the more difficult it is to sell securities in a short period of time and without a significant decline in price. This risk is controlled by the selection of stocks with active market trading.

How the premium service works

Step 1

Talk about your goals

Fill out an 8-question questionnaire about your attitude toward risk, goals, and investment experience

Fill in the form

Step 2

Define the risk profile

Based on the results of the questionnaire, the manager will determine your risk appetite and type of behavior in financial markets

Step 3

Form a portfolio

We will choose the best strategy based on your goals

Determine your risk profile in 2 minutes

Answer 8 questions

Investor risk profile

Conservative

An investor with this risk profile is not prepared for portfolio drawdowns. Your main focus:

to preserve and multiply capital without significant risk. The main asset class for investment in this case - U.S. government securities. The Quantum Capital Treasury strategy will suit a conservative investor for his goals.

to preserve and multiply capital without significant risk. The main asset class for investment in this case - U.S. government securities. The Quantum Capital Treasury strategy will suit a conservative investor for his goals.

This questionnaire is not a questionnaire for accurately determining the investment profile of a client that meets all the requirements and rules for carrying out securities management activities. To understand your risk appetite, send the questionnaire to the manager for a detailed consultation. He will determine your type of behavior in the financial markets and select the appropriate investment strategy.

Send the questionnaire to the manager

QC Treasury

Estimate yield

3-5%

Optimal investment period

6+ months

Investor risk profile

Moderate

An investor with such a risk profile is not prepared for portfolio drawdowns of more than 5-10%. Your main focus: to preserve capital and protect it from inflation. The main asset class for investment in this case are bonds and money market funds. The Quantum Capital Fixed Income Plus strategy will assist the conservative investor in his goals.

This questionnaire is not a questionnaire for accurately determining the investment profile of a client that meets all the requirements and rules for carrying out securities management activities. To understand your risk appetite, send the questionnaire to the manager for a detailed consultation. He will determine your type of behavior in the financial markets and select the appropriate investment strategy.

Send the questionnaire to the manager

Fixed Income Plus

Yield for 2021

6,82%

Estimate yield

8,1%

Optimal investment period

from 2 years

Investor risk profile

Moderate-aggressive

An investor with this risk profile is prepared to withstand serious market declines during a crisis (up to 50%). Your main focus: to maximize capital appreciation. As a rule, such an investor holds the majority of his portfolio in stocks. For this investor, the Quantum Capital Value Equity strategy, where 70% of the portfolio is stocks of U.S. companies, is suitable.

This questionnaire is not a questionnaire for accurately determining the investment profile of a client that meets all the requirements and rules for carrying out securities management activities. To understand your risk appetite, send the questionnaire to the manager for a detailed consultation. He will determine your type of behavior in the financial markets and select the appropriate investment strategy.

Send the questionnaire to the manager

Value Equity

Yield for 2021

22,0%

Estimate yield

13,3%

Optimal investment period

from 2 years