QC Treasury

QC Treasury — is an absolute return strategy and does not have a benchmark.

The strategy is suitable for risk-averse investors who aim to achieve capital security, receive income and protect capital invested. As part of our strategy, we invest in risk-free US government securities, preferably with short maturities, that are guaranteed by the US government.

Benchmark is a benchmark, the return on which serves as a model for comparing the performance of investments.

Estimated yield

(USD)

4-5%

Optimal investment period

1+ year

Investor Memorandum

Base currency

USD

Optimal investment period

от 1 year

Minimum entry threshold

by agreement

Estimated yield

4-5%

Management fee

0.5%

Success fee

0%

Profile of the investor

The strategy Quantum Capital QC Treasury is suitable for investors, who:

Want not only achieve capital security, but also income;

Not willing to put up with low deposit rates in banks;

Do not tolerate fluctuations in the value of a portfolio;

Have a short-term investment horizon.

The main goal of the strategy

Invest in risk-free US government securities. Suitable for risk-averse investors who aim to achieve capital security, receive income and protect capital invested.

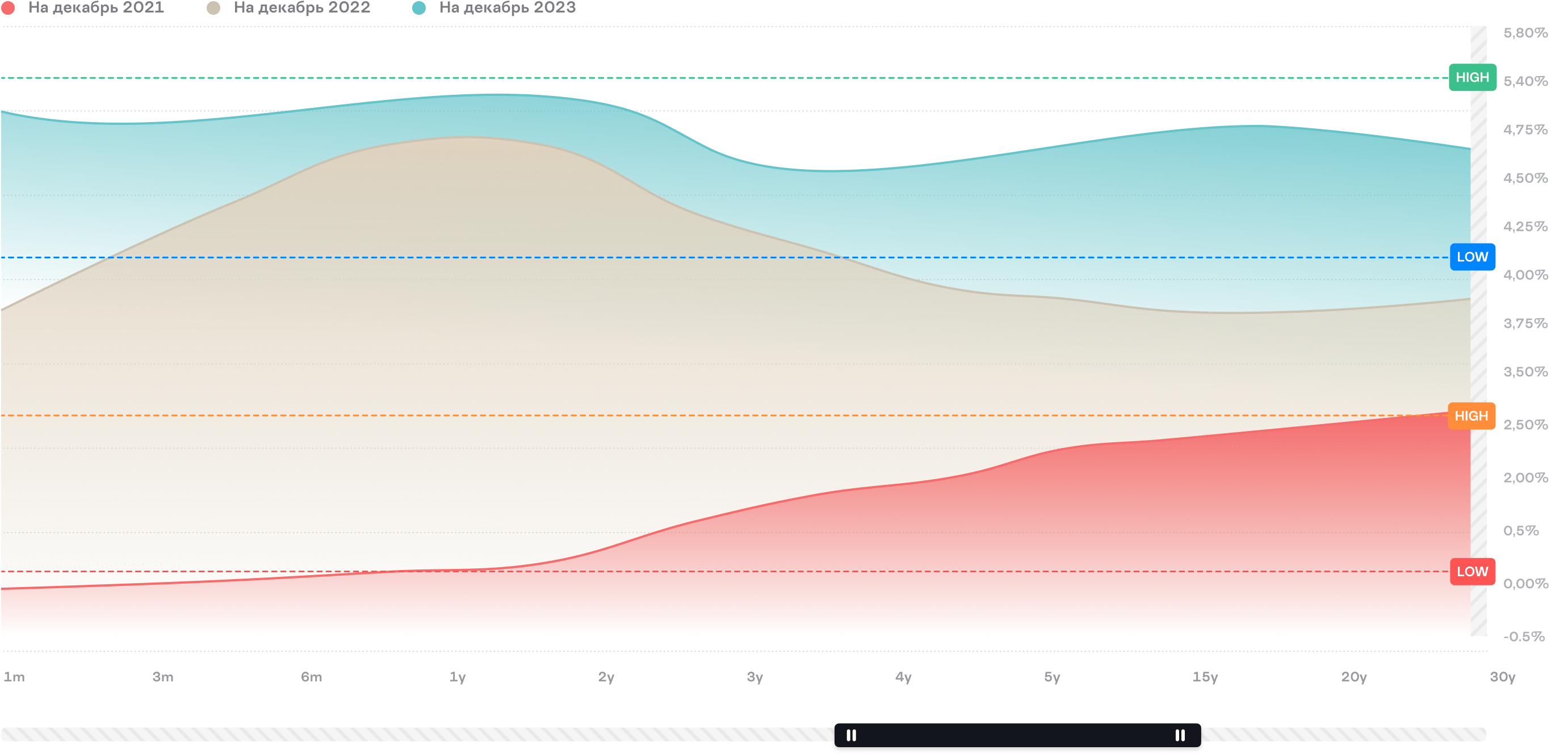

U.S. Treasury yield curve

Advantages of QC Treasury

We charge the lowest

management fee

management fee

We buy bonds through auctions and constantly roll over bills in compliance with the target duration

We keep assets in

reliable custodian banks such as

Morgan Stanley and Saxo Bank

reliable custodian banks such as

Morgan Stanley and Saxo Bank

Comparison of the strategy with alternative products

Name:

Yield:

Risks:

Payment periodicity:

QC Treasury

3-5%

Low

According to maturities

USD Deposit

1 %

Moderate

Flexible

Currency MFs

5 %

High

Quarterly

Example of a portfolio

QC Treasury

QC Treasury

*Duration is the period to maturity of government bonds

** Example of a portfolio of $1,000,000 invested on Dec 22. 2022

Position:

Share (%)

Duration* (months)

Yield to Maturity

(ann., %)

Expected yield, USD**

Rating

Trasury Bill Govt

15

3

4.17%

$ 6.255

AAA

Trasury Bill Govt

65

6

4.48%

$ 29.120

AAA

Trasury Note Govt

20

12

4.37%

$ 8.740

AAA

Total:

100

6.75

4.41%

$ 44.155

AAA

How the premium service works

Step 1

Talk about your goals

Fill out an 8-question questionnaire about your attitude toward risk, goals, and investment experience

Fill in the form

Step 2

Define the risk profile

Based on the results of the questionnaire, the manager will determine your risk appetite and type of behavior in financial markets

Step 3

Form a portfolio

We will choose the best strategy based on your goals

Determine your risk profile in 2 minutes

Answer 8 questions

Investor risk profile

Conservative

An investor with this risk profile is not prepared for portfolio drawdowns. Your main focus:

to preserve and multiply capital without significant risk. The main asset class for investment in this case - U.S. government securities. The Quantum Capital Treasury strategy will suit a conservative investor for his goals.

to preserve and multiply capital without significant risk. The main asset class for investment in this case - U.S. government securities. The Quantum Capital Treasury strategy will suit a conservative investor for his goals.

This questionnaire is not a questionnaire for accurately determining the investment profile of a client that meets all the requirements and rules for carrying out securities management activities. To understand your risk appetite, send the questionnaire to the manager for a detailed consultation. He will determine your type of behavior in the financial markets and select the appropriate investment strategy.

Send the questionnaire to the manager

QC Treasury

Estimate yield

3-5%

Optimal investment period

6+ months

Investor risk profile

Moderate

An investor with such a risk profile is not prepared for portfolio drawdowns of more than 5-10%. Your main focus: to preserve capital and protect it from inflation. The main asset class for investment in this case are bonds and money market funds. The Quantum Capital Fixed Income Plus strategy will assist the conservative investor in his goals.

This questionnaire is not a questionnaire for accurately determining the investment profile of a client that meets all the requirements and rules for carrying out securities management activities. To understand your risk appetite, send the questionnaire to the manager for a detailed consultation. He will determine your type of behavior in the financial markets and select the appropriate investment strategy.

Send the questionnaire to the manager

Fixed Income Plus

Yield for 2021

6,82%

Estimate yield

8,1%

Optimal investment period

from 2 years

Investor risk profile

Moderate-aggressive

An investor with this risk profile is prepared to withstand serious market declines during a crisis (up to 50%). Your main focus: to maximize capital appreciation. As a rule, such an investor holds the majority of his portfolio in stocks. For this investor, the Quantum Capital Value Equity strategy, where 70% of the portfolio is stocks of U.S. companies, is suitable.

This questionnaire is not a questionnaire for accurately determining the investment profile of a client that meets all the requirements and rules for carrying out securities management activities. To understand your risk appetite, send the questionnaire to the manager for a detailed consultation. He will determine your type of behavior in the financial markets and select the appropriate investment strategy.

Send the questionnaire to the manager

Value Equity

Yield for 2021

22,0%

Estimate yield

13,3%

Optimal investment period

from 2 years