Investment strategies

Quantum Capital’s analysts are constantly testing new hypotheses, while also developing our existing models and adapting them to changes in the markets

Become a client

Ask me a question

S. Turumbetova

Head of Sales Department

Investment Principles

Investing in stocks as long-term business ownership

Fundamental analysis combined with machine learning algorithms

A balanced approach to risk-taking and profit-making

QC Investment Funds

Investment strategies of Quantum Capital Ltd are implemented on the basis of open private investment fund registered in the Astana International Financial Centre (AIFC).

QC Value Equity Fund

Expected return

The interest rate or amount that an investor expects to receive over a specified period of time from an investment in a particular asset.

15% p.a.

Amount invested

от 50.000.USD.

Optimal investment period

2-5 years

This is a higher-risk strategy that suits investors who want higher returns and have a greater appetite for risk. The strategy seeks to outperform the US stock market (its benchmark is the SPY ETF).

more

QC Tenge Fixed Income Fund

Investment Currency

KZT, USD, EUR

Expected Yield

Higher than the deposit rate with the BVU RK

Acceptable risk

For investors with above average risk profile

Asset Management

Medium-term investment horizon (1-3 years)

QC investment strategies

Investment strategies of Quantum Capital Ltd for clients' accounts on Trust.

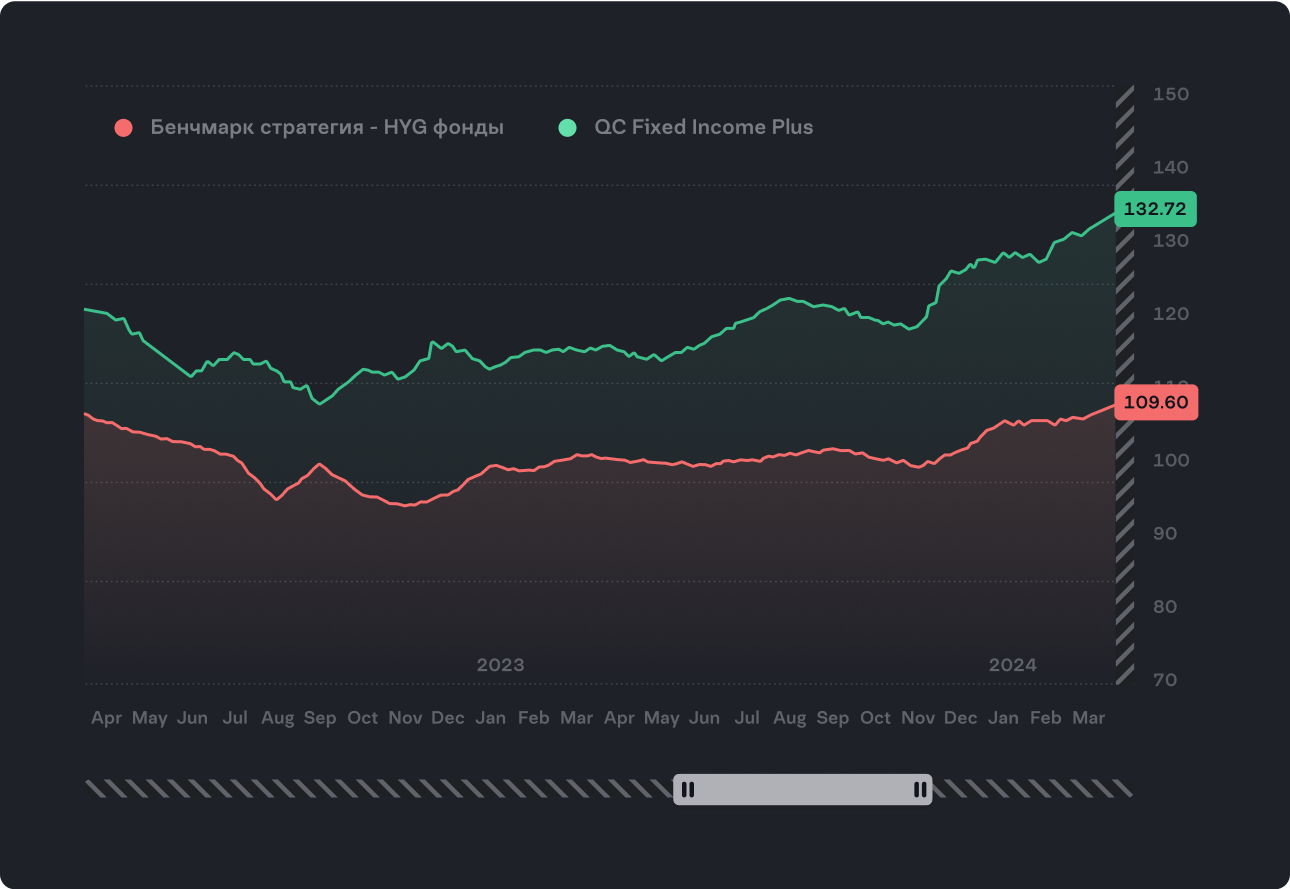

QC Fixed Income Plus

Estimated yield (in USD)

Estimated yield - the interest rate or amount an investor expects to receive over a certain period of time from an investment in a particular asset.

8%

Investment amount

The amount of investment on the client's personal brokerage account is set by agreement with the company's management

by agreement

Optimal investment period

2 years+

This strategy suits conservative investors who want stable capital growth with a lower-risk investment style. The aim of the strategy is to outperform the dollar bond market in the medium term and still have a comparable risk level.

Read more

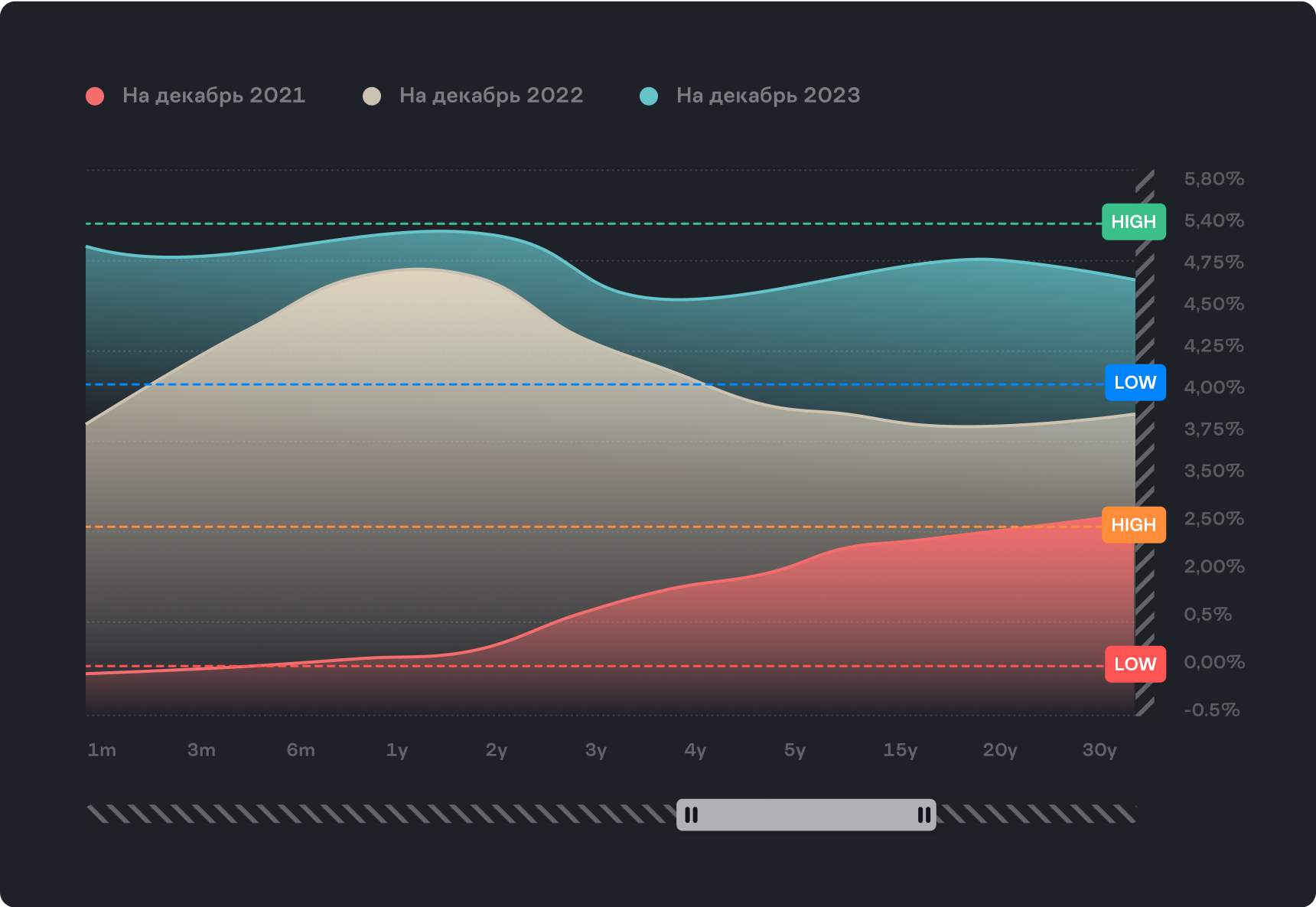

QC Treasury

Expected yield (in USD)

4-5%

Optimal investment period

1+ year

The strategy is suitable for risk-averse investors who aim to achieve capital security, receive income and protect capital invested. As part of our strategy, we invest in risk-free US government securities, preferably with short maturities, that are guaranteed by the US government.

Read more

Strategy

Tax support

The purpose of tax support is to help you take the first steps in setting up your accounts, filling out forms, and dealing with personal declaration issues. We make sure that every QC client can focus on their core business, not their taxes. To that end:

We keep our finger on the pulse and keep an eye on all tax reporting deadlines, so you have one less thing to worry about

We save your time by eliminating the need to deal with taxes

We provide advice and help with personal tax returns

Example of tax support services

Analysis of personal tax return filing obligations in Kazakhstan

Assistance with obtaining documents from the tax authorities, such as tax residency certificates, certificates of taxes paid, and so on

Full tax support, from the calculation of your taxable income to preparation of your annual personal income tax return

Advice about your tax obligations, such as how to avoid double taxation

Check your taxes

Get help structuring and optimizing all your tax obligations

FAQ

Do you guarantee returns?

Investments in the securities market and all financial products involve risk. An investor's capital can rise or fall and losses can exceed the size of the initial investment. Just like the manager of a public company, hedge fund management is not personally liable to shareholders and investors. Hedge funds are an instrument with a higher risk profile. Our profits come from an investor's positive return, so we are interested in maintaining successful performance.

How do I know the status of my portfolio and where do I track my returns?

You can see the status of your portfolio in your client portal. You will be able to monitor your portfolios and track returns in real time. Clients are offered a wide range of customizable reports and statements for various needs, from trading reports to comprehensive performance analysis. The app makes it easy to check your overall performance and examine transaction data in-depth.

Are you strictly following a strategy?

We advocate a balanced and considered approach, so we follow a strategy without jumping from position to position, which is historically an effective approach and is confirmed by long-term stock market returns. We analyze the market and monitor the risks, so adjustments to the chosen strategy can be made in agreement with the client.

Can a third party deposit and withdraw funds to the account?

It is not possible to deposit or withdraw funds from a third-party account.

Can heirs or beneficiaries be assigned?

Yes. To specify heirs and beneficiaries, you should contact a notary.

How can I enter into an inheritance?

Heirs come into the right of inheritance according to the law. In the event of a client's death, a notary sends an official request in writing to Quantum Capital MC and draws up a Certificate of Inheritance Rights based on our response. After receiving this document, the heir contacts the management company and completes the necessary formalities, such as reregistering the portfolio in his/her own name.

How do you deal with contingency risks such as Covid-19?

Investment risks.

The Asset Management team constantly monitors the markets and tracks trends, so we foresaw the spread of the coronavirus before the introduction of large-scale lockdowns in Europe and the US. Based on our analysis, we purchased long-term US government bonds, which rose while the market was falling, and in April we switched back to stocks and corporate bonds.

Operational Risks.

The entire Asset Management team has access to trading software and can monitor the portfolio and trade remotely.

The Asset Management team constantly monitors the markets and tracks trends, so we foresaw the spread of the coronavirus before the introduction of large-scale lockdowns in Europe and the US. Based on our analysis, we purchased long-term US government bonds, which rose while the market was falling, and in April we switched back to stocks and corporate bonds.

Operational Risks.

The entire Asset Management team has access to trading software and can monitor the portfolio and trade remotely.

Get Started Now

Invest with Quantum Capital

If you’re looking for a way to maintain and increase your capital, send us an inquiry and our consultants will be in touch with detailed information

Send us an inquiry