QC Tenge Fixed Income Fund

The strategy will suit conservative investors who want stable capital growth without an aggressive investment style. The goal of the strategy is to outperform the dollar bond market in the medium term while given a comparable level of risk. The portfolio risk averaged 7.6% over 10 years, which confirms the strategy's goal. The HYG

index fund is taken as the

benchmark for this market since the alternative option for the investor is to purchase shares of this fund.

HYG - the iShares iBoxx $ High Yield Corporate Bond ETF seeks to track the investment results of an index composed of U.S. dollar-denominated, high yield corporate bonds.

Benchmark is a benchmark, the return on which serves as a model for comparing the performance of investments.

Yield for 2023

%

15%

Estimated yield

(USD)

8%

Optimal investment period

from years

2

The strategy uses machine learning

Investor Memorandum

Base currency

USD

Optimal investment period

from 2 years

Minimum entry threshold

by agreement

Estimated yield

8%

Management fee

1.5%

Success fee

15%

Investor's profile

The Quantum Capital Fixed Income Plus strategy is suitable for investors, who:

Want stable capital growth

Not willing to put up with low deposit rates in banks

Ready for small fluctuations in the value of your portfolio

Understand the disadvantage of selling bonds in a hurry

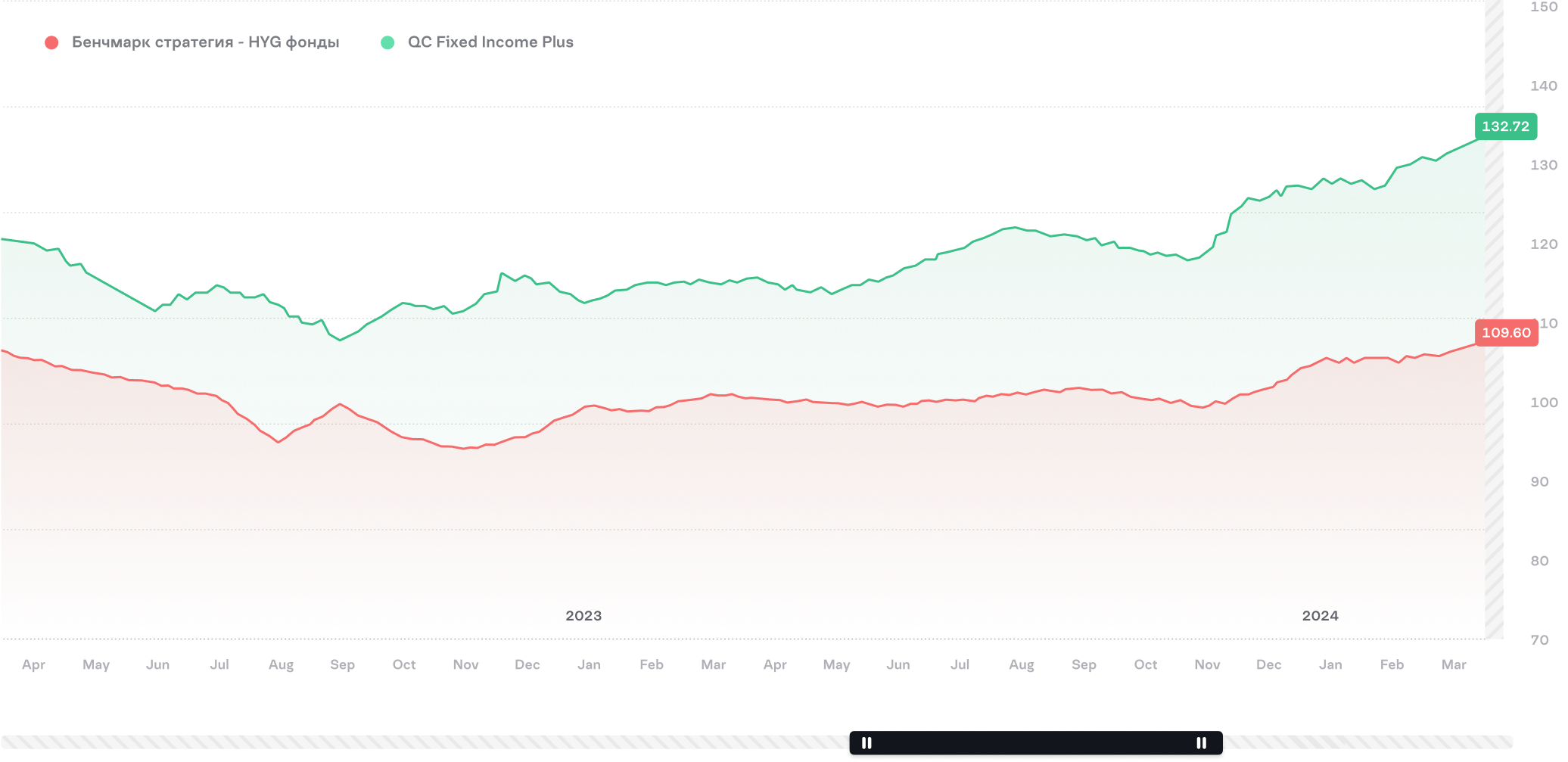

Comparison of yields

The effectiveness of the strategy

February 2020 - June 2024

Accumulated profitability for the period

An indicator of how much the strategy has grown since the strategy was launched.

34.47%

Average annual return

An indicator of how much the strategy has grown on average over the year since the strategy was launched.

6.94%

Strategy Sharpe Ratio

An indicator of how scattered returns are relative to the average. Used as a measure of the relative riskiness of an asset. For example, a riskier asset has a high standard deviation.

7.61%

Sharpe Ratio

A measure of investment performance that considers both the performance of a security or portfolio and its risks. I.e. the return on investment per unit of risk.

-0,06%

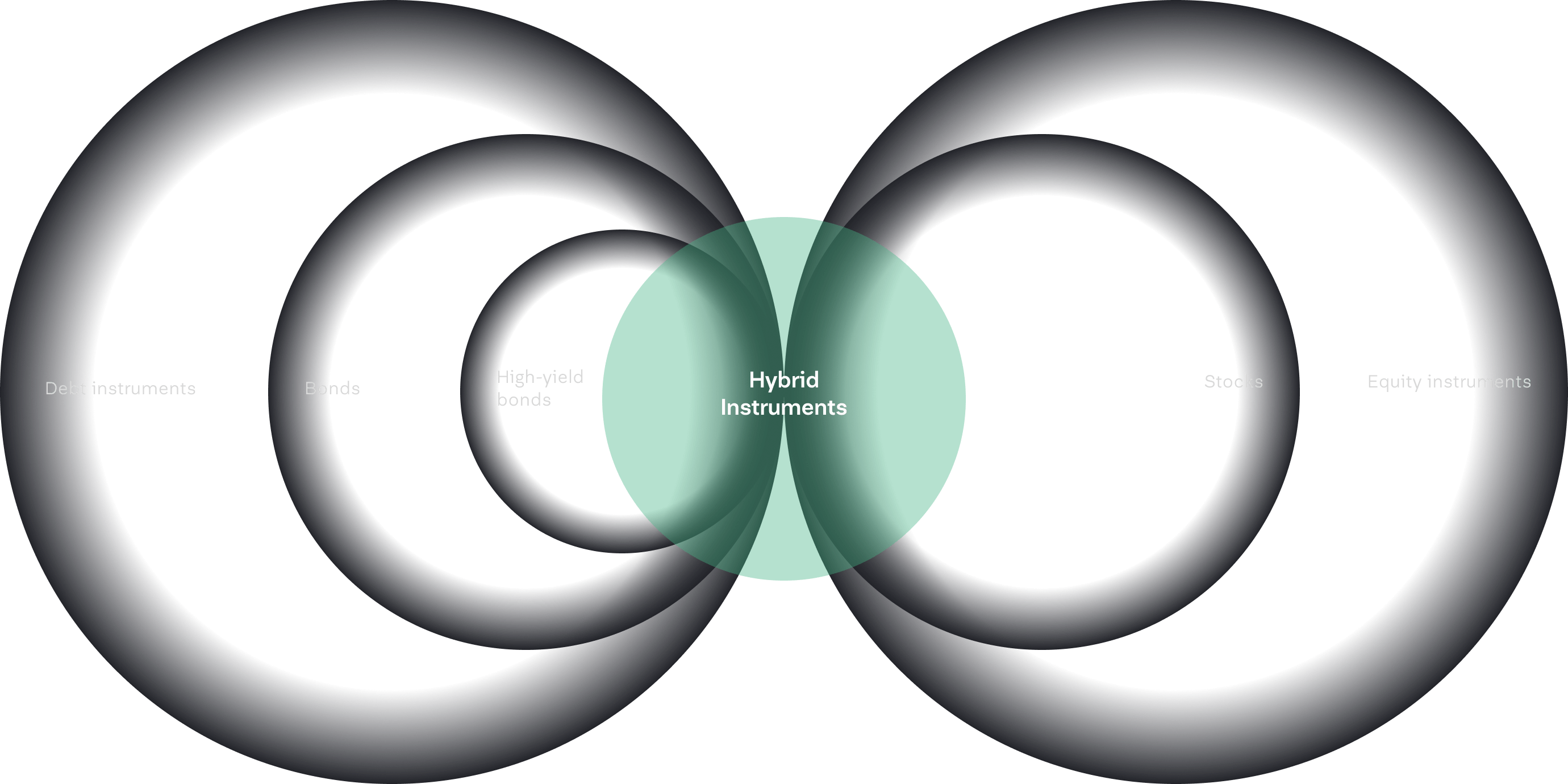

Strategy tools

Given the strategy's goal of outperforming the bond market at comparable risk, portfolio instruments should be broadly similar in type. The HYG index fund consists of high-yield bonds - that is, bonds of companies that are in poor financial condition that may have losses, declining revenues, lots of debts and other complications. By lending to such companies, investors want to be compensated for the risk they take, and so the returns on such bonds are higher than those of quality issuers.

60%

Debt securities, bond exchange-traded funds

This is the main tool of the strategy. High-yield bonds of the HYG index fund are included in this asset type. They also include "low-yield" bonds - debt of quality companies. With the ability to move away from high-yield bonds, we can reduce the portfolio's credit risk, but increase others such as buying stocks, hybrid instruments or long-dated bonds.

20%

Perpetual bonds, preferred shares, convertible debt instruments

Secondary instruments of the strategy. These securities are interesting because they are similar to both bonds as well as stocks and therefore offer higher returns than the former.

20%

Stocks and currencies

These types of assets can be purchased in cases where we are confident in the investment ideas and cannot allow the investor to miss out on the opportunity making money. These assets are enabled to use derivative instruments in order to hedge risks.

ETF

ETN

ETC

All of the above instruments are allowed to be purchased both directly and through ETFs, ETNs, ETCs and structured products

Target portfolio structure

Significant deviations from the target structure are permitted and expected

Approach to investing

When selecting bonds, we take the following approach

Choice of bond currency

Given the goal of the strategy - profitability in U.S. dollars, in most cases we choose the U.S. dollar. However, we can also choose other currencies in case we do not expect currency risks.

Focus on actively traded instruments

High-volume bonds and recently issued securities trade much more active than older instruments, which settle in the portfolios of pension funds and are held there until maturity.

Credit rating

84

Good rating!

Choosing a credit rating

Credit ratings roughly indicate a company's financial condition. The lower the rating, the less stable the company, the higher the bond yields.

Focus on core expertise

in which the managers have expertise. We exclude some sectors, such as pharmaceuticals and biotechnology, due to their specific nature. Also, not wanting to expose investors to the risk of weakening of the tenge, we do not invest in the oil and gas sector and oil-exporting countries.

After selecting bonds using the above filters, we see the overall picture

Bonds above the centerline present a more interesting yield/duration ratio. However, the market demands higher yields from these instruments for a reason - it is possible that these issuers have financial difficulties.

Our task, as managers, is to analyze these companies, their industry, macro-factors, securities, and make a conclusion - how justified such yields are and whether these bonds are worth buying.

Risk management

The goal of the risk strategy

Volatility comparable to the HYG index, i.e., the standard deviation of return should not exceed 7.6% on average

Key strategy risks

Credit, interest rate, and concentration risk. We also consider currency and liquidity risk

Credit risk

The likelihood that the company will not be able to pay its bonds. This happens if the company does not earn enough cash and a "default" occur. To avoid defaults in investors' portfolios, managers carefully analyze companies and the scope of their business and make cash-flow projections.

Interest rate risk

The extent to which changes in interest rates affect instrument prices. When interest rates rise, bond prices fall as investors have the opportunity to place money at higher rates. The higher bond's duration, the higher sensitivity to interest rate changes. To manage this risk, QC forecasts interest rates and their probabilities of change. Depending on that, it decides whether to buy long-term bonds.

Concentration risk

Vulnerability of a portfolio to the results of a single company. If there is only one instrument in an investor's portfolio, he or she is completely dependent on that security's returns. Securities with lower correlation provide better risk diversification.

Currency risk

The probability that changes in exchange rates will lead to losses. However, it arises only when investing in non-dollar instruments. QC intends to purchase such securities only after careful macroeconomic analysis to minimize currency risk.

Liquidity risk

The degree of difficulty in selling the instruments. The higher this risk, the more difficult it is to sell securities in a short period of time and without a meaningful decline in price. This risk is controlled by the choice of more tradable instruments, with higher trading volume in circulation.

How the premium service works

Step 1

Talk about your goals

Fill out an 8-question questionnaire about your attitude toward risk, goals, and investment experience

Fill in the form

Step 2

Define the risk profile

Based on the results of the questionnaire, the manager will determine your risk appetite and type of behavior in financial markets

Step 3

Form a portfolio

We will choose the best strategy based on your goals

Determine your risk profile in 2 minutes

Answer 8 questions

Investor risk profile

Conservative

An investor with this risk profile is not prepared for portfolio drawdowns. Your main focus:

to preserve and multiply capital without significant risk. The main asset class for investment in this case - U.S. government securities. The Quantum Capital Treasury strategy will suit a conservative investor for his goals.

to preserve and multiply capital without significant risk. The main asset class for investment in this case - U.S. government securities. The Quantum Capital Treasury strategy will suit a conservative investor for his goals.

This questionnaire is not a questionnaire for accurately determining the investment profile of a client that meets all the requirements and rules for carrying out securities management activities. To understand your risk appetite, send the questionnaire to the manager for a detailed consultation. He will determine your type of behavior in the financial markets and select the appropriate investment strategy.

Send the questionnaire to the manager

QC Treasury

Estimate yield

3-5%

Optimal investment period

6+ months

Investor risk profile

Moderate

An investor with such a risk profile is not prepared for portfolio drawdowns of more than 5-10%. Your main focus: to preserve capital and protect it from inflation. The main asset class for investment in this case are bonds and money market funds. The Quantum Capital Fixed Income Plus strategy will assist the conservative investor in his goals.

This questionnaire is not a questionnaire for accurately determining the investment profile of a client that meets all the requirements and rules for carrying out securities management activities. To understand your risk appetite, send the questionnaire to the manager for a detailed consultation. He will determine your type of behavior in the financial markets and select the appropriate investment strategy.

Send the questionnaire to the manager

Fixed Income Plus

Yield for 2021

6,82%

Estimate yield

8,1%

Optimal investment period

from 2 years

Investor risk profile

Moderate-aggressive

An investor with this risk profile is prepared to withstand serious market declines during a crisis (up to 50%). Your main focus: to maximize capital appreciation. As a rule, such an investor holds the majority of his portfolio in stocks. For this investor, the Quantum Capital Value Equity strategy, where 70% of the portfolio is stocks of U.S. companies, is suitable.

This questionnaire is not a questionnaire for accurately determining the investment profile of a client that meets all the requirements and rules for carrying out securities management activities. To understand your risk appetite, send the questionnaire to the manager for a detailed consultation. He will determine your type of behavior in the financial markets and select the appropriate investment strategy.

Send the questionnaire to the manager

Value Equity

Yield for 2021

22,0%

Estimate yield

13,3%

Optimal investment period

from 2 years