Fixed Income Plus

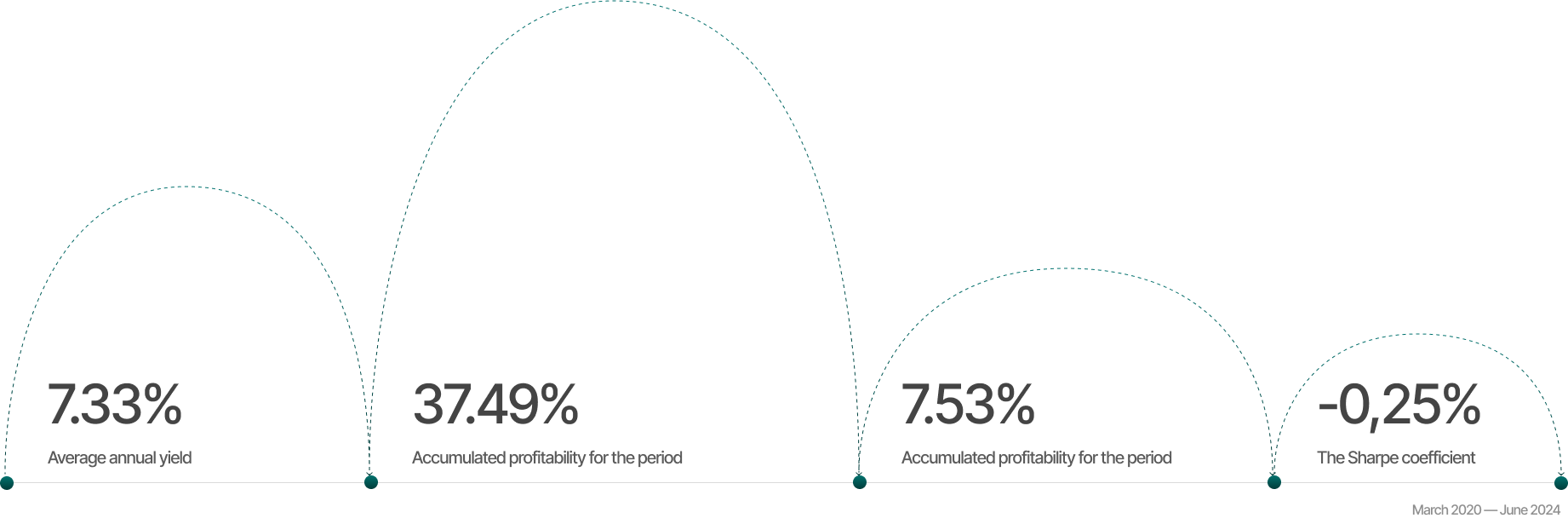

The strategy is suitable for conservative investors who advocate stable capital gains without an aggressive investment format. The goal of the strategy is to outperform the dollar bond market in the medium term and at the same time have a comparable level of risk. The portfolio's risk averaged 7.6% over 10 years, which confirms the strategy's goal. The HYG index fund is used as a benchmark for this market, as an alternative option for an investor is to purchase shares of this fund.

-

1

6.5%

return for 2024

-

2

6-8%

Estimated return (USD)

-

3

2+ years old

Optimal investment period

Investor Memorandum

-

Base currency:

USD USD -

Minimum entry threshold:

by agreement by agreement -

Estimated return:

6-8% 6-8%

-

Management fee:

1.5% 1.5% -

Commission for success:

15% 15% -

Optimal investment period:

2+ years old 2+ years old

Investor profile

The Quantum Capital Fixed Income Plus strategy is suitable for investors who:

- Moderate capital gains are expected

- Looking for an alternative to low dollar deposit rates

- We are ready for small fluctuations in the value of the portfolio

- Have a long-term investment horizon

Strategy Tools

-

Debt instruments

Long-term investments in sustainable companies

60% -

Hybrid tools

Medium-term ideas and investments in selected sectors:

Perpetual bonds, preferred shares, convertible debt instruments.

Secondary strategy tools. These securities are interesting because they resemble both bonds and stocks, and therefore offer higher returns.

20% -

Other tools

Stocks and currencies.

This type of asset is available for purchase when we are confident in investment ideas and cannot allow the investor to miss the opportunity to earn. It is allowed to use production tools for the purpose of hedging risks.

20%

Given the strategy's goal of outperforming the bond market with comparative risk, the portfolio's instruments should generally be similar in type. The HYG index fund consists of high–yield bonds - that is, bonds of companies with poor financial condition, which may have losses, falling revenue, a lot of debt and other problems. By lending to such companies, investors want to be compensated for the risk they take, and therefore the yield of such bonds is higher than that of high-quality issuers.

Approach

to investing

-

Stage 1

Currency selection of bonds

-

Stage 2

Emphasis on actively traded instruments

-

Stage 3

Choosing a credit rating

-

Stage 4

Focus on sectors and countries with expertise

-

Given the goal of the strategy – return in US dollars, in most cases the US dollar is chosen. At the same time, we can choose other currencies if we do not expect currency risks.

-

High-volume bonds and newly issued securities are traded much more actively than older instruments that settle in pension fund portfolios and are held there until maturity

-

Credit ratings roughly indicate the financial condition of the company. The lower the rating, the less stable the company is, the higher the bond yields.

-

We exclude certain sectors, such as pharmaceuticals and biotechnologies, due to their specifics. Also, not wanting to expose investors to the risk of a weakening tenge, we do not invest in the oil and gas sector and oil exporting countries.

Risk management

Volatility comparable to the HYG index, i.e. the standard deviation of the yield on average should not exceed 7.6%.

-

Credit risk

The probability that the company will not be able to pay its bonds. This happens if the company does not earn enough money and a "default" occurs. To prevent defaults in investors' portfolios, managers carefully analyze companies and their field of activity, and make cash flow forecasts.

-

Interest rate risk

The degree of influence of changes in interest rates on the prices of instruments. When interest rates rise, the value of bonds falls, as investors have the opportunity to place money at higher rates. And the higher the maturity of the bond, the more the price drops. To manage this risk, the QC predicts interest rates and the likelihood of their changes. Depending on this, it is decided whether it is worth buying longer–term bonds.

-

Concentration risk

The vulnerability of the portfolio to the results of one company. If there is only one instrument in the investor's portfolio, then it depends entirely on the return of this security. Multiple tools compensate for each other's movements and reduce the risk of concentration.

-

Currency risk

There is a possibility that changes in exchange rates will lead to losses. However, it only occurs when investing in non-dollar instruments. QC intends to purchase such securities only after a thorough macroeconomic analysis to minimize currency risk.

-

Liquidity risk

The degree of difficulty with the sale of tools. The higher this risk, the more difficult it is to sell securities in a short period of time and without significantly reducing the price. This risk is controlled by choosing more tradable instruments with more volume in circulation.

How the premium service works

-

Tell us about your goals

Fill out an 8-question questionnaire about your risk attitude, goals, and investment experience

01 -

Let's define the risk profile

Based on the results of the questionnaire, the manager will determine your risk appetite and type of behavior in the financial markets

02 -

Let's form a portfolio

We will choose the best strategy based on your goals

03 -

We will help you open an account

Full support at all stages of the process

04

Write to us if you have any questions

Fill out the form and our manager will contact you and answer your questions

Attach file